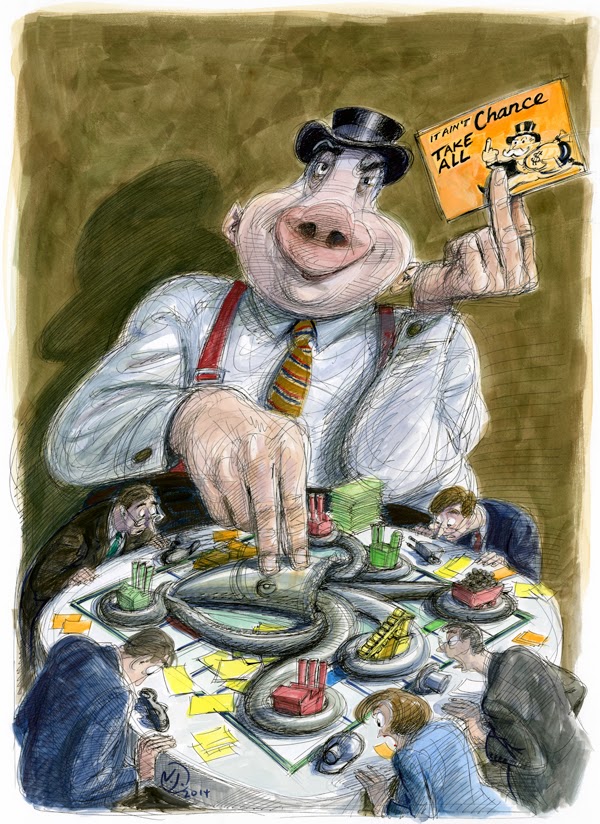

The Vampire Squid Strikes Again: The Mega Banks' Most Devious Scam Yet

Feb 12, 2014 | Rolling Stone | Matt Taibbi

Call

it the loophole that destroyed the world. It's 1999, the tail end of

the Clinton years. While the rest of America obsesses over Monica

Lewinsky, Columbine and Mark McGwire's biceps, Congress is feverishly

crafting what could yet prove to be one of the most transformative laws

in the history of our economy – a law that would make possible a broader

concentration of financial and industrial power than we've seen in more

than a century.

But the crazy thing is, nobody at the time quite knew it. Most

observers on the Hill thought the Financial Services Modernization Act

of 1999 – also known as the Gramm-Leach-Bliley Act – was just the latest

and boldest in a long line of deregulatory handouts to Wall Street that

had begun in the Reagan years.

Wall Street had spent much of that era arguing that America's banks

needed to become bigger and badder, in order to compete globally with

the German and Japanese-style financial giants, which were supposedly

about to swallow up all the world's banking business. So through

legislative lackeys like red-faced Republican deregulatory enthusiast

Phil Gramm, bank lobbyists were pushing a new law designed to wipe out

60-plus years of bedrock financial regulation. The key was repealing –

or "modifying," as bill proponents put it – the famed Glass-Steagall Act

separating bankers and brokers, which had been passed in 1933 to

prevent conflicts of interest within the finance sector that had led to

the Great Depression. Now, commercial banks would be allowed to merge

with investment banks and insurance companies, creating financial

megafirms potentially far more powerful than had ever existed in

America.

All of this was big enough news in itself. But it would take half a

generation – till now, basically – to understand the most explosive part

of the bill, which additionally legalized new forms of monopoly,

allowing banks to merge with heavy industry. A tiny provision in the

bill also permitted commercial banks to delve into any activity that is

"complementary to a financial activity and does not pose a substantial

risk to the safety or soundness of depository institutions or the

financial system generally."

Complementary to a financial activity. What the hell did that mean?

"From the perspective of the banks," says Saule Omarova, a law

professor at the University of North Carolina, "pretty much everything

is considered complementary to a financial activity."

Fifteen years later, in fact, it now looks like Wall Street and its

lawyers took the term to be a synonym for ruthless campaigns of world

domination. "Nobody knew the reach it would have into the real economy,"

says Ohio Sen. Sherrod Brown. Now a leading voice on the Hill against

the hidden provisions, Brown actually voted for Gramm-Leach-Bliley as a

congressman, along with all but 72 other House members. "I bet even some

of the people who were the bill's advocates had no idea."

No comments:

Post a Comment