After years of talking about it, we are finally poised to control our own energy future.- Obama in 2013 State of The Union address.

The myth of American energy independence from fracking has been dealt a huge blow by the downgrade of recoverable oil from the Monterey shale formation. The U.S. Energy Information Administration (EIA) has slashed its estimate of oil reserves from the Monterey shale formation by a massive 96%.

In 2011 the EIA released a report that reviewed US shale oil and gas reserves. It stated that the largest shale oil formation in America was the Monterey play in Southern California. The report estimated that the Monterey shale formation held 15.5 billion barrels of oil or 64% of total U.S. shale oil reserves.

California's vast shale deposits were labelled ''black gold'' due to this forecast. On the basis of this rosy review the University of California produced a report forecasting millions of new jobs and billions in extra tax revenues.

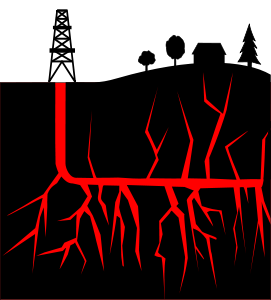

Such academic reports have played a part in encouraging the media frenzy that has tried desperately to promote fracking to the American people as a clean, safe industry that will create jobs, foster a renaissance in manufacturing industry, increase tax revenues and help America be independent of supplies from its geopolitical enemies.

On top of this, American imperialism is using these inflated claims for its energy reserves to advance its geopolitical interests. The Obama administration are using the crisis in Ukraine to put pressure on their puppet allies in the EU to wean themselves off Russian gas and buy American fracking gas in the future.

At a press briefing before Obama's June trip to Poland, Belgium and France Deputy National Security Advisor for Strategic Communications Ben Rhodes said:

Frankly, the Ukraine crisis has brought into sharp relief Europe’s energy dependence on Russia, so we are going to work closely with our European allies on the importance of both short- and long-term efforts to diversify their energy sources, to modernize their infrastructure, and to limit Russia’s ability to use energy as a tool of political leverage.The big gas companies are drooling at the prospect of selling fracking gas abroad. There are two bills before Congress that hope to fast track exports of liquefied gas: Senate Bill 2274 and House Bill 6. Obviously, the gas corporations don't care two figs for the energy supplies of Europe but they do want to sell fracking gas abroad. They can get a much higher price in Europe than they can get domestically. This means a huge increase in profits.

The 96% downgrade of recoverable oil reserves from the Monterey shale formation which were supposed to represent two-thirds of America's shale oil reserves is big news. However, this news was overshadowed by the giant mega gas deal between Russia and China that came out the same day.

Industry Response

You will not find any corporate politician or mainstream media outlet that will discuss the significance of the Monterey shale oil downgrade. The oil industry itself tries to brush off the significance of this downgrade by the EIA.

Industry spokespeople claim that big oil has far from given up on the prospect of extracting tight oil in California through multi-stage horizontal fracking. They have vowed to continue to find ways to extract tight oil in California. In a recent statement Catherine Reheis-Boyd, President of the Western States Petroleum Association said:

We have a great deal of confidence that the skill, experience and innovative spirit possessed by the men and women of the petroleum industry will ultimately solve this puzzle and improve production rates from the Monterey Shale.Reality Check

If we put industry propaganda to one side, the reality is that this downgrade represents a huge blow to the fracking industry. Not only them, but also to the capitalist politicians in Congress, who put such great hopes on oil and gas from fracking.

California state Senator Holly Mitchell, sponsor of anti-fracking legislation, told ABC News in May:

"The cost-benefit analysis of fracking in California has just changed drastically."

Referring to the 96 percent reduction, she asks, "Why put so many at risk for so little? We now know that the projected economic benefits are only a small fraction of what the oil industry has been touting. There is no ocean of black gold that fracking is going to release tomorrow, leaving California awash in profits and jobs.Ashley Miller, Executive Director of the Post Carbon Institute, commented:

The downgrade of the Monterey should raise questions about the veracity of the EIA’s other estimates, especially considering their past track record with other plays (notably the Marcellus). It should put the so-called “shale revolution” into perspective, particularly because the typical life cycle of a shale play appears to be very short.Statistical Fantasy

Tom Whipple, a highly respected peak oil analyst, has cast doubt on the new revised figure of 600 million barrels, ''which in itself may be high.''

J.David Hughes, geologist, has extensively studied the Monterey shale formation. He produced a study in 2013 which showed the EIA's 2011 forecast was vastly overstated. “The oil had always been a statistical fantasy. Left out of all the hoopla was the fact that the EIA’s estimate was little more than a back-of-the-envelope calculation.”

In 2013 Hughes produced the most comprehensive analysis to date of prospects for shale gas and tight oil in the United States. His landmark Drill Baby Drill report seriously undermines the media myth that the United States is on the verge of becoming an energy superpower that will rival Saudi Arabia and Russia. Hughes has noted the significance of the massive downgrade in recoverable oil reserves in California.

"Monterey was a huge field wiped out with a stroke of a pen: That's like two Bakkens off the table in one fell swoop,'' Hughes said. "You're going to have a whole slew of poorly producing wells in a decade or so. The good news is that supply grows short term, but the bad news is that we may have a very serious supply issue 10-15 years out."The economics of fracking just does not add up

The American people need to be made aware that the oil and gas fracking industry will not deliver on its promises of a jobs boom that will foster a manufacturing renaissance and deliver higher tax receipts. The economics of fracking just does not add up.

Continue reading..

No comments:

Post a Comment